Project information on Food Park in Thanh Hoa province

I. General view on project

1. Name of project: Investment Project on Food Park

2. Objectives of project

Food Park is the park which has fully and synchronously developed infrastructure; links with local material areas and regional wholesale markets; provide full necessary services to businesses in food sector to set up its business in the zone in a complete value chain from cultivation, farming; cold chain, storage; food processing; packaging; shipment and trading. The products are stored and produced to meet high standard to export mostly to overseas markets and partly in domestic market.

3. Form of investment: - Investors may select one of the following investment forms: BCC, joint-venture, 100%foreign or domestic capital.

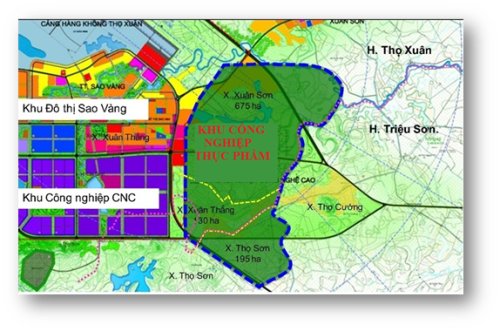

4. Location, scope of project:

The Food Park is proposed to be located in Thanh Hoa High-tech Agricultural zone in Tho Xuan and Trieu Son districts, Thanh Hoa province with 1000 ha of area(Detailed Planning 1/2000 of the zone approved in Decision No. 2394/QD-UBND dated 29 June 2015 by Thanh Hoa PPC);

Boundaries:

- Tho Xuan airport to the North;

- Communal road linked with national road No.47 of Tho Son commune, Trieu Son district to the South;

- Tho Ngoc and Tho Cuong communes, Trieu Son district to the East;

- Lam Son-Sao Vang urban area to the West

| GEOGRAPHICAL LOCATION OF THANH HOA PROVINCE |

5. Comparative advantages:

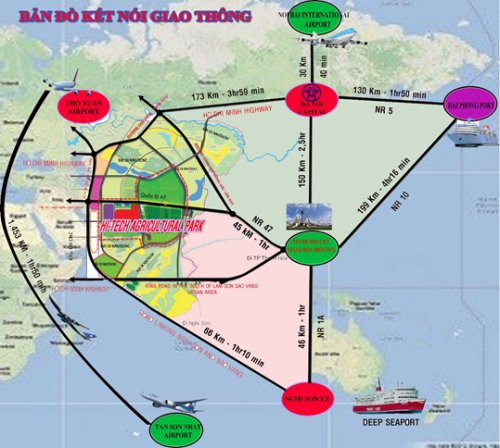

5.1. Convenient geographical location

- The Food Park is expected to be located in Lam Son-Sao Vang dynamic economic region of Thanh Hoa province, which has direct and favorable linkage with other parts of the province, with Ho Chi Minh city, Hanoi capital and Lao People’s Democratic Republic via national roads no.47, no.217, Ho Chi Minh highway, national road no.15A and airway. This area has advantages and potentials of forest, land sources, minerals and tourism; abundant labor force; long-standing culture and industrious tradition. As one of four dynamic economic clusters in Thanh Hoa province, this area has strategy and orientation to develop green industry and agriculture sector, high tech industries, in combination with development of a service-tourism urban area and sustainable development.

- Land status: Agricultural and forestry land is major and there are several households in 03 communes of Xuan Son, Xuan Thang and Tho Son (site clearance is supported by the province).

5.2. Distance to the key areas:

- 40 km from Thanh Hoa city to the West (by national road no. 47);

- 180km via Ho Chi Minh highway or 200km via national road No. 1A from Hanoi to the South;

- 1,600 km from Ho Chi Minh city (1 hour and 40 minutes by air);

- 64 km from Nghi Son deep-water sea port (which can accommodate ships of 50,000 tons and be able to receive ships of 100,000 tons after dredging);

- 225 km from Hai Phong port to the South;

Proposed location of Food Park |

5.3. Important infrastructure workshas impact on Food Park:

- Tho Xuan airport with flights to Ho Chi Minh city, Buon Ma Thuot city and being promoted to develop international flights.

- Construction of 65-kilometer road linking Tho Xuan airport and Nghi Son deep-water seaport, expected to be completed in December 2017.

5.4. Power supply, water supply, telecommunication infrastructure:

- Power supply system: Stable power supply source with capacity of 2 x 25 MVA;

- Water supply: from Water Plant;

- Telecommunication: Completed telecommunication infrastructure.

5.5. Linkages with material areas:

Thanh Hoa PPC has issued Decision No. 4833/QD-UBND dated 31 December 2014 related to Master Plan of Agricultural development in Thanh Hoa province to 2025, orientation to 2030,in which the hi-tech agricultural zone aligned with food processing are planned as follows:

- 1,000 ha of clean vegetables and fruits area in Song Am Farm in Ngoc Lac district, 40km from Food Park via Ho Chi Minh highway;

- 1,169 ha of high quality milk and beef cattle breeding area in Lam Son Farm in Ngoc Lac district, 25 km from Food Park;

- Intensive sugarcane farming area and hi-tech agricultural area of Lam Son Sugar Corporation Company in Tho Xuan district, 15km from Food Park;

5.6. Big and potential market

- Thanh Hoa province is located in the North Central part of Vietnam with the natural area of 11,116 square kilometers, ranking the 5th largest province in the country; Its population is nearly 3.5 million, ranking the 3rd in the country after Hanoi Capital and Ho Chi Minh City. Thanh Hoa has regional linkage advantage, influenced by the Northern and Central key economic regions, Thanh Hoa province has role as development motivation of North-central region. If investors invest in Thanh Hoa, they will receive advantages as follows:

+ Favorable location: Thanh Hoa has a synchronous and favorable transport system, including: roads, railway, waterway and airline. The province has many important national roads passing through like the national road 1A, Ho Chi Minh highway; Na Meo international border gate trading with Laos People’s Democratic Republic; Tho Xuan airport with Thanh Hoa – Ho Chi Minh route, Thanh Hoa - Buon Ma Thuot route and it is promoting to develop new routes; It has Nghi Son deep sea port which is accommodating ships of 50,000 tons and able to receive ships of 100,000 tons after dredging.

+ There are many big domestic and foreign enterprises who invested and registered to invest in Thanh Hoa province, confirmed the belief of investors on mechanism, attracting investment policies and investment environment of Thanh Hoa province. These enterprises such as: Nghi Son Cement Plant is a joint-venture of Vietnam Cement Industry Corporation (Vicem) and two Japanese multinational corporations including Taiheyo Cement (TCC) and Mitsubishi Material (MMC); Nghi Son Refinery and Petrochemical Complex with USD 9 billion of investment capital is a joint-venture of Vietnam Petrolimex, Kuwait Petroleum International Company and Idemitsu Kosan Company from Japan; Nghi Son Thermal Power Plant no.1 and no.2 of investor combination of Marubehi Corporation (Japan) and Kepco (Korea) as main contractors; FLC Sam Son Beach and Golf resort of FLC group,etc.

In agriculture and food processing sector, there are the projects such as: Lam Sam Sugar Coporation Company is implementing High-tech agricultural investment project in Tho Xuan district, project on Center of Dairy farms with scale of 16,000 cows in Yen Dinh district of Vinamilk; TH Truemilk Corporation has been granted Investment registered certificate of the project on Concentrated dairy farming with industrial scale of about 20,000 cows ; Hoang Anh Gia Lai Group is investing in the project on high quality beef with the scale of 10,000 cows imported from Australia in Ba Thuoc district; FLC group and Vingroup are implementing High-tech agricultural zone projects in Lam Son farm and Song Am farm; North Continental Oils and Fats Vietnam Company Limited is a joint venture between Vietnam Vegetable Oil Industry Corporation and Singapore’s Musim Mas Vietnam Oils & Fats Pte. Ltd. This company has kick-started the construction of its $71.5 million facility for producing edible oils and derivative products in Nghi Son EZ.

+ Diverse terrain and ecosystems in Thanh Hoa are favorable conditions for agricultural development; natural area of 1,111,600 ha, in which: agro-forestry and aqua production land of 846,908 ha, large coastal area with length of 102 km; Thanh Hoa has both moon soon climate (hot, wet and rainy) and cold winter; it is divided to several different small regions with different natural conditions, favorable for growing characteristics of many crops and livestock. Potentials of large area and abundant soil types facilitate Thanh Hoa province developing high quality agriculture, especially agricultural products serving for local and export demand. With those potentials, Thanh Hoa province is forming agricultural production zones associated with processing and consumption in value chain, bringing effective results, contributing to improving productivity, quality, effectiveness, competitive ability and sustainable development, facilitating for enterprises investing in processing and production sector, typically such as: productive, effective, high quality rice zone with over 70,000 ha of area; Sugarcane material zone with over 30,000 ha of area, providing annually approximately 2 million tons for 03 sugar processing plants with total capacity of 19,000 tons of sugarcane per day. Cassava material zone with 11,000 ha, providing annually approximately 180,000 tons for 03 cassava starch processing plants with total capacity nearly 2000 tons per day. Rubber material zone with 18,000 ha of area, providing annually approximately 5,000 tons of dried latex rubber for manufacturers in province. The largest bamboo material zone in the country with 70,000 ha of area.

+ Plentiful labor resource: Thanh Hoa province now has the golden population structure, abundant human resources, with 2.1 million labors and labor qualification is relatively higher compared with the national average.

+ Harmonious history, culture, nature and urban life: Thanh Hoa has now still preserved many unique, attractive and popular historic, cultural relics such as the Citadel of the Ho Dynasty recognized as the World's Cultural Heritage by UNESCO.It has many beautiful beaches such as: Sam Son, Hai Tien, Hai Hoa. Thanh Hoa province has great potentials to develop diversified tourism services, especially high-quality ones, such as marine tourism, eco-tourism, cultural, historical and spiritual tourism.

6. Duration: 70 years of land lease duration and able to be extended if investor has requirement.

7. Attractive investment incentives policies

7.1. Competitive cost

- The land rent rate = the percentage of land rent unit price x price of land (according to the purpose of the land use issued published annually by ThanhHoa Provincial People's Committee), in which:

+ Production and business land price in 2014 as stipulated in Decision No. 4545/2014/QD – UBND dated 18 December 2014 of Thanh Hoa Provincial People's Committee: the lowest price is 0.147 USD/m2/year, the highest price is 0.627 USD/m2/year.

+ The percentage of land rent unit price in Lam Son-Sao Vang high-tech agricultural zone as stipulated in Decision No. 1928/2014/QD – UBND dated 12 June 2014 of Thanh Hoa Provincial People's Committee is 0.5%.

- Attractive labor cost

+ The minimum salary of unskilled labor: 100 USD/person/month;

+ Average salary: 150 USD/person/month;

+ The social insurance contributions: 26% (of which the company: 18% employee: 8%);

+ Medical insurance: 4.5% (including the company: 3%, employee 1.5%);

+ Unemployment insurance: 2% (including the company: 1%, the employees: 1%).

- The cost of road transport (container, bulk cargo):

+ From Lam Son-Sao Vang high-tech agricultural zone to Hai Phong port, Nghi Son Port, to HochiminhCity: 0.1 – 0.15 USD/ton/km (subject to time);

- Ocean freight (container ships):

+ FromNghi Son port to Hai Phong port: 8 - 10 USD/ton;

+ FromNghi Son port to Vung Tau port: 30 - 40 USD/ton

7.2.Investment incentives

7.2.1 The incentives for infrastructure investors

According to Decree 118/2015/ND-CP dated 11/12/2015 of the Government on detailed regulations and guidelines for implementation of some articles of the Law on Investment, the investment projects in the field of special investment incentives (Construction, business in industrial park infrastructure, high-tech zones ..) and investment in areas with special difficult socio-economic conditions (high-tech zones), this project is a special encouraged investment project; should be entitled to the following incentives:

- Incentives for land:

Exemption from land and water surface rent for the whole period of the lease (As stipulated in Decree 46/2014/ND-CP of the Government dated 05/15/2014 regarding regulations on land and water surface rents collection)

- Incentives for corporate income tax:

+ 10% preferential tax rate for a period of 15 years;

+ Exemption 4 years, reduction of 50% of the tax payable for the next 9 years

(Under the provisions of Decree 218/2013/ND-CP of the Government dated 26/12/2013 providing details and guiding the implementation of the Law on Corporate Income Tax)

- Incentives for import-export tax:

((As stipulated in Decree 87/2010 / ND-CP dated 13/08/2010 providing details some articles of the Law on Export and Import Tax)

Be exempt from tax in the following cases:

+ Goods temporarily import for re-export or temporarily export for re-import for participation in trade fairs, exhibitions, product introduction;

+ Goods that are movable assets of organizations and individuals in Vietnam or abroad brought into Vietnam or brought abroad within the prescribed limit;

+ The goods are imported to create fixed assets of investment projects in the field of preferential import tax;

7.2.2. The incentive for investors to invest in farming projects, processing and storage of agricultural, forestry and fisheries:

As stipulated in Decree No 118/2015/ND-CP of the Government dated 12/11/2015 providing details and guiding the implementation of some articles in the Law on Investment, the projects that are expected to call for investment in Foof Park is the investment projets in the fields of special investment incentives (farming, processing and storage of agricultural, forestry and fisheries) and investment in the especially difficult region (High tech industrial zone). So these projects are especial incentive projects, should be entitled to the highest policy as stipulated in Decree 210/2013/ND-CP of the Government on policies to encourage enterprises to invest in agriculture and rural development; as follows:

- Incentives for land:

Exemption from land and water surface rent for the whole period of the lease (As stipulated in Decree 46/2014/ND-CP of the Government dated 05/15/2014 regarding regulations on land and water surface rents collection)

- Incentives for corporate income tax:

+ 10% preferential tax rate for a period of 15 years;

+ Exemption 4 years, reduction of 50% of the tax payable for the next 9 years

(Under the provisions of Decree 218/2013/ND-CP of the Government dated 26/12/2013 providing details and guiding the implementation of the Law on Corporate Income Tax)

- Incentives for import-export tax:

((As stipulated in Decree 87/2010 / ND-CP dated 13/08/2010 providing details some articles of the Law on Export and Import Tax)

Be exempt from tax in the following cases:

+ Goods temporarily import for re-export or temporarily export for re-import for participation in trade fairs, exhibitions, product introduction;

+ Goods that are movable assets of organizations and individuals in Vietnam or abroad brought into Vietnam or brought abroad within the prescribed limit;

+ The goods are imported to create fixed assets of investment projects in the field of preferential import tax;

- Other incentives and supports:

+ Support 70% of domestic vocational training expenses. Each labor will be trained only once a year and the duration of training eligible for support must not exceed 6 months.

+ Support 50% of advertising costs for the businesses and products on mass media; 50 % costs of participation into domestic exhibitions and fairs; reduction of 50% of charges for accessing market information and services provided by the State trade promotion agencies.

+ Support 70% of businesses’s costs for conducting research to create new technologies in order to execute the project, or to buy technology copyright to execute the project; Support 30% of total new investment cost to conduct pilot production project.

7.2.3. Investors having investment projects related to construction of factories, facilities for food processing and storage, production of supporting products will be supported by the government as follows:

+ Support not more than 60% of costs which has total amount not exceeding 5 billion VND per project to build infrastructure works such as waste treatment, transport, power and water supply, factories and equipment procurement within the project fence.

+ Support not more than 70% of waste treatment costs for large-scale operating agro-forestry processing factories which recruit many labors and have big impact on local economy and society.

+ Support transport cost with norm of 1,500 VND/ton/km for the distance from the factory or storage, processing facilities to the center of province or to municipal cities of that province in the nearest motorways. The transport quantity is pursuant to actual capacity of the factory; The government support one time after the investment completion. Total time of support is 5 years.

+ In addition to these above supporting policies, if there are no traffic roads, power system, water supply and drainage to the project fence, the project will be supported 70% of costs which has total amount not exceeding 5 billion VND per project to build above-mentioned items (investors may prepare a separate project).

7.2.4. Investors with investment projects on industrial concentrated cattle and poultry slaughters will be supported by the government as follows:

+ Support at least two billion VND for a project to build infrastructure works of power and water supply, factories, waste treatment and equipment procurement.

+ In case there are no traffic roads, power system, water supply and drainage to the project fence, the project will be supported 70% of costs which has total amount not exceeding 5 billion VND to build above-mentioned items.

7.2.5. Under Decision 5643/2015/QĐ-UBND dated 31/12/2015 of the People's Committee of Thanh Hoa province on the issuance of policies and mechanisms to encourage the implementation of restructuring the agricultural sector in Thanh Hoa province, the period from 2016 to 2020.

- Support for organizations, businesses and individuals with investment projects to lease land or water surface of households and individuals in the province of Thanh Hoa to the agricultural production of large-scale concentrated according to the provisions, 5 years after the project goes into operation, namely:

+ Support for land lease expense to 3 million dong/ ha / year to produce: rice, special rice, corn, sugarcane, thick corn and animal feed grass and fruit trees (orange, grapefruit).

+ Support for water rent expense to 4 million dong/ha/year for intensive tilapia farming for export.

+ Support for water rent expense to 6 million dong/ha/ year to feed intensive vannamei

- Support business associated with families and individuals to produce and consumer products of crops: potatoes, sweet corn, baby corn, baby cucumber, exporting melon, export peppers, tomatoes, onions, garlic, vegetables, thick corn and grass for feed types of dairy, beef cows farming on the rice land to ensure the conditions according to the provisions as follows:

+ Support the production of potatoes, tomatoes, green pumpkin, onion, garlic, vegetables: 5 million dong/cultivated ha/ year.

+ Support the production of sweet corn, baby corn, baby cucumber, export cucumber, export peppers: 3 million dong/ cultivated ha/ year.

+ Support thick corn and grass for feed types of dairy, beef cows: 2 million dong/ cultivated ha/year

+ Support for organizations and individuals to be a focal point for storage, processing, consumption: Supports 1.5 million dong/ cultivated ha/year for cooperatives, enterprises processing, agricultural preservation to search consumer market.

- The provincial government will arrange 100% funds to carry out site clearance compensation and clean hand over the business to invest in concentrated agricultural processing facilities and forest products ... ; will hand over the clean area to build factories, machinery and equipment, warehouse ...

7.2.6. Enterprises with foreign capital are permitted to mortgage their land use right, assets attached to the leased land at credit institutions which are licensed to operate in Vietnam, in the land use duration)

(As stipulated in section b, Clause 2, Article 183 in Land Law no. 45/2013/QH13, dated 29/11/2013).

8. Contact information

- Thanh Hoa Planning and Investment Department

Address: No. 45B - Le Loi Avenue- Thanh Hoa city

Phone: (84-37) - 3- 852366; Fax: (84-37) - 3- 851451

- Thanh Hoa Investment, Trade and Tourism Promotion Agency

Address: No. 41 Le Loi Avenue- Thanh Hoa city

Phone: (84-37) - 3- 716867; Fax: (84-37) - 3- 716866

Email: trungtamxuctien@thanh hoa.gov.vn